Keep more of your money with 2-10 HBW!

The cost to repair a major appliance or replace a major system can be expensive and inconvenient, especially when you don’t expect it. When a system or appliance that your household depends on breaks down, a 2-10 HBW home warranty can save the day. It’s the easiest and most affordable way to make your home whole again.

1 Statistics derived from 2019 data. Based on estimated average retail repair costs and observed claims experiences of 2-10 HBW customers.

2 National averages based on data collected in November 2021. Costs in your area may vary.

**Service Fee per approved claim. See service agreement for all coverage details, limitations, and exclusions.

Home warranty protection that’s simple and affordable.

From prearranged packages to personalized plans, 2-10 HBW gives you more choices for your life, needs, and budget.

Check out some of our packages below or learn more about personalizing!

Buying or selling your home? Learn more about our real estate plans.

Why choose a warranty from 2-10 HBW?

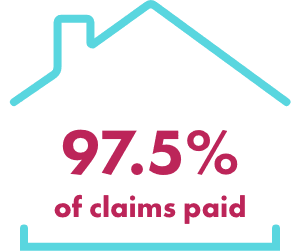

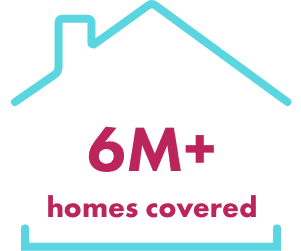

A home warranty is an incredible tool for keeping your budget on track. Here’s why you should choose 2-10 HBW to protect your home!

Why homeowners trust us to protect their home

How it works

2-10 HBW has a network of independent service contractors that help facilitate your coverage. Each contractor is required to carry all appropriate licenses and insurance, and is monitored by 2-10 HBW to track customer satisfaction and performance.

A homeowner contacts us when a covered system or appliance breaks down.

A contractor diagnoses the problem and reports back to us.

We determine and fulfill coverage under the Service Agreement.

Check for low-cost plans for your home.

All coverage and options are subject to terms, limits, exclusions, and procedures.

See the Service Agreement for all applicable details.

Frequently asked questions

A home warranty (or Home Warranty Service Agreement as we call it) is a powerful budget-protecting service contract for homeowners that can provide coverage for things that homeowners insurance doesn’t.

A home warranty is an annual contract that can help reduce the costs to repair or replace covered systems and appliances that break down from normal wear and tear.

Homeowners insurance covers loss from incidents like fire, storms, or vandalism. The coverages provided by a home warranty and homeowners insurance typically don't overlap and often complement one another to provide comprehensive protection.

Your Service Agreement could cover certain systems like central air conditioning, heating, and water heaters, along with appliances like refrigerators, stoves, washers, and dryers. You can view each plan’s specific details in the section above.

If you are a homeowner, you can purchase a 2-10 HBW home warranty at any time.

Yes. If the covered system or appliance is in working order when you purchase a 2-10 HBW home warranty (i.e., doesn't have a pre-existing problem), age doesn't matter.

A Service Fee is a relatively small payment you make to the contractor when you submit a service request. When you choose 2-10 HBW, you’ll typically pay $100 or less to have a contractor service your breakdown. Then, 2-10 HBW covers the remaining covered repair or replacement costs, up to the clearly stated limits in your service contract.

A home warranty may cover certain systems like central air conditioning, heating, plumbing, electrical, and water heaters, as well as appliances like refrigerators, stoves, washers, and dryers. For a complete list of what a 2-10 HBW home warranty covers, check out our systems and appliances page.

Simple and affordable home warranty plans

Check for low-cost home warranty plans for your home.